What Is The Expected Change In Equity Value If All Yields Increase By 300 Basis Points?

Definition of interest charge per unit risk in the banking book

98.1

Involvement rate hazard in the banking volume (IRRBB) refers to the current or prospective risk to a bank's capital and to its earnings, arising from the bear upon of agin movements in interest rates on its banking volume.

98.2

Excessive IRRBB can pose a meaning threat to a bank's current majuscule base or futurity earnings if not managed appropriately. Changes in interest rates can bear upon the underlying economical value of the banking concern'southward assets, liabilities and off-rest sail instruments, because the nowadays value of time to come cash flows (and, in many cases, the amounts of cash flows themselves) change when involvement rates change. Changes in interest rates also affect a bank's earnings by increasing or decreasing its net interest income (NII) and the level of other interest charge per unit-sensitive income and operating expenses.

98.3

Fundamentally, there are two distinct methods for valuing banking volume items, namely:

(1)

"amortised" (or "historical") cost, where values are based on initial cost less accumulated depreciation, taking account of the expected life / maturity of the particular; and

(2)

"fair" (or "market") value, where values are based on market place prices (where available) or on the net nowadays value of expected cash flows, discounted at the prevailing rate (where no market price is bachelor).

98.4

For items held at amortised cost, market involvement rate changes do non significantly affect profit recognition or bookkeeping values for existing instruments (significant changes in values would be from harm that needs to be recognised as a permanent diminution in value). Income/price on items held at amortised price therefore emerges over fourth dimension in line with maturity-adapted cash flows.1

98.5

Accounting values of fair valued instruments tin can vary significantly from period to menses, due to changes to external factors (eg interest charge per unit changes can impact both the expected time to come cash flows and the discount charge per unit used for calculation purposes). Income and cost are recognised either through profit and loss (P&L) or through equity, on the basis of changes to embedded value.

98.6

Since nearly IRRBB economic value measures aim to approximate the change in economic value nether shocks and stresses, the presence or absence of higher/lower bookkeeping values for amortised cost instruments is finer ignored, equally is the emergence of profit over fourth dimension. It is therefore of import to note that a loss in economical value does non automatically equate with accounting losses for this chemical element of the banking volume. Conversely, for assets held at fair value/mark-to-market, changes in involvement rates directly affect current accounting values, and thus have an immediate impact on both P&Fifty and available capital.

98.7

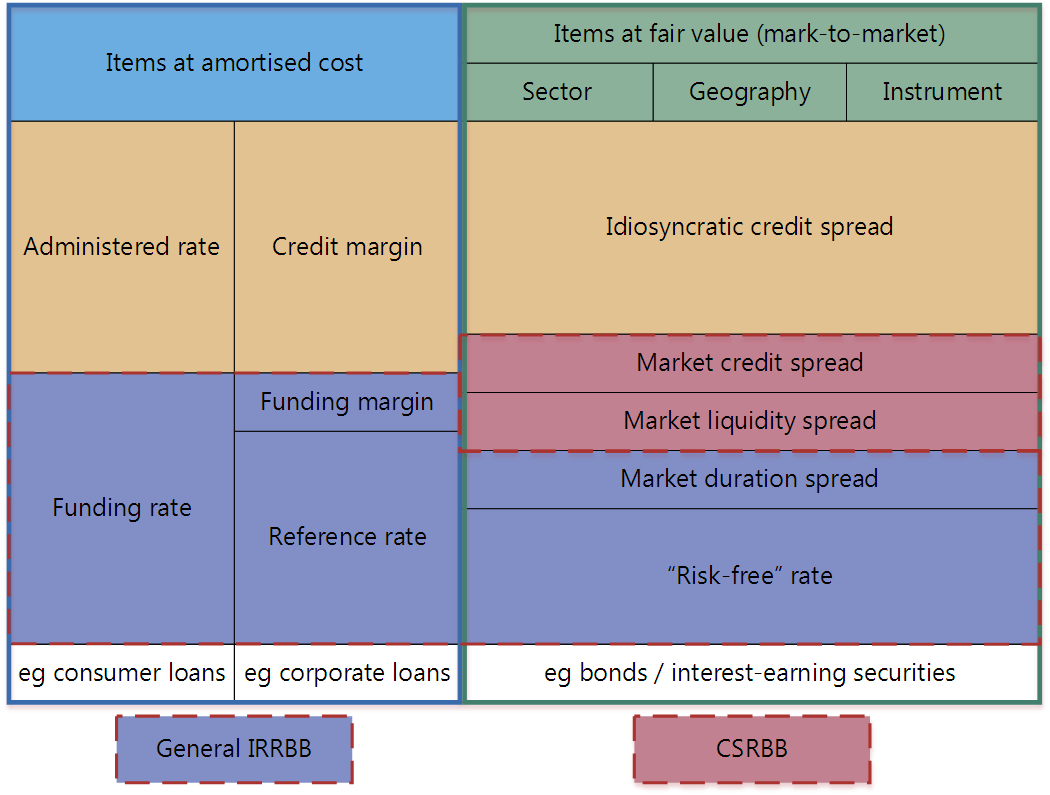

Every interest rate earned by a bank on its assets, or paid on its liabilities, is a composite of a number of toll components – some more than easily identified than others. Theoretically, all rates comprise five elements.

(1)

The run a risk-free rate: this is the fundamental building cake for an interest rate, representing the theoretical rate of interest an investor would await from a risk-complimentary investment for a given maturity.

(2)

A market elapsing spread: the prices/valuations of instruments with long durations are more vulnerable to marketplace interest rate changes than those with brusk durations. To reverberate the uncertainty of both greenbacks flows and the prevailing interest charge per unit surroundings, and consequent price volatility, the market requires a premium or spread over the chance-free charge per unit to encompass elapsing risk.

(3)

A marketplace liquidity spread: even if the underlying instrument were risk-gratuitous, the involvement rate may incorporate a premium to represent the marketplace appetite for investments and the presence of willing buyers and sellers.

(4)

A full general market credit spread: this is singled-out from idiosyncratic credit spread, and represents the credit risk premium required by market participants for a given credit quality (eg the boosted yield that a debt instrument issued by an AA-rated entity must produce over a risk-complimentary alternative).

(5)

Idiosyncratic credit spread: this reflects the specific credit take chances associated with the credit quality of the individual borrower (which volition besides reverberate assessments of risks arising from the sector and geographical/currency location of the borrower) and the specifics of the credit instrument (eg whether a bond or a derivative).

98.8

In theory these rate components apply beyond all types of credit exposure, just in practice they are more readily identifiable in traded instruments (eg bonds) than in pure loans. The latter tend to acquit rates based on two components:

(1)

The funding rate, or a reference rate plus a funding margin: the funding rate is the composite internal toll of funding the loan, reflected in the internal funds transfer price (for larger and more than sophisticated banks); the reference rate is an externally set criterion rate, such as the London Interbank Offered Rate (LIBOR) or the federal funds rate, to which a bank may need to add (or from which it may need to decrease) a funding margin to reverberate its own all-in funding rate. Both the funding rate and the reference rate incorporate liquidity and duration spread, and potentially some elements of market credit spread. However, the relationship between the funding charge per unit and market reference rate may not be stable over time – this divergence is an case of basis risk.

(2)

The credit margin (or commercial margin) applied: this can be a specific addition (eg LIBOR + 3%, where the three% may include an element of funding margin) or built into an administered rate (a rate prepare by and under the absolute command of the bank).

98.9

In do, decomposing interest rates into their component parts is technically demanding and the boundaries between the theoretical components cannot easily be calculated (eg changes to market credit perceptions tin besides change market liquidity spreads). Equally a result, some of the components may be aggregated for interest rate risk management purposes.

98.10

Changes to the take a chance-gratis rate, marketplace duration spread, reference rate and funding margin all autumn inside the definition of IRRBB. Changes to the market liquidity spreads and market credit spreads are combined within the definition of credit spread run a risk in the banking volume (CSRBB). The diagram below gives a visual representation of how the various elements fit together.

98.11

The primary driver of IRRBB is a change in market interest rates, both electric current and expected, equally expressed by changes to the shape, gradient and level of a range of different yield curves that incorporate some or all of the components of involvement rates.

98.12

When the level or shape of a yield curve for a given interest charge per unit basis changes, the relationship between interest rates of different maturities of the same index or market, and relative to other yield curves for different instruments, is affected. This may event in changes to a banking concern'due south income or underlying economic value.

98.thirteen

CSRBB is driven by changes in market perception about the credit quality of groups of different credit-risky instruments, either because of changes to expected default levels or considering of changes to marketplace liquidity. Changes to underlying credit quality perceptions can amplify the risks already arising from yield bend risk. CSRBB is therefore defined equally any kind of asset/liability spread risk of credit-risky instruments which is not explained by IRRBB, nor by the expected credit/bound-to-default run a risk.

98.14

This affiliate and SRP31 focus mainly on IRRBB. CSRBB is a related risk that needs to be monitored and assessed.

98.15

IRRBB derives from iii central aspects relating to the level and structural characteristics of interest rates, and the effects on these of changes to yield curves. These aspects of interest rate take chances can occur simultaneously, and therefore need to be managed holistically.

(1)

Gap take a chance arises from the term structure of banking book instruments, and describes the risk arising from the timing of instrument rate changes. Since rate resets on different instruments occur at dissimilar tenors, the risk to the bank arises when the rate of involvement paid on liabilities increases before the rate of interest received on assets, or reduces on assets before liabilities. Unless hedged in terms of tenor and amount, the banking company may be exposed to a flow of reduced or negative involvement margins, or may experience changes in the relative economic values of avails and liabilities. The extent of gap risk depends also on whether changes to the term construction of interest rates occur consistently across the yield curve (parallel risk) or differentially by period (non-parallel gamble).2

(two)

Ground take chances describes the impact of relative changes in interest rates for financial instruments that take similar tenors merely are priced using different interest rate indices (bases) (eg an asset priced off LIBOR funded past a liability priced off US Treasuries). It arises from the imperfect correlation in the adjustment of the rates earned and paid on different instruments with otherwise similar rate change characteristics. For the purposes of this chapter, IRRBB is divers as excluding changes in idiosyncratic credit margins.

(iii)

Option run a risk arises from option derivative positions or from the optional elements embedded in many bank assets, liabilities and off-balance sheet items, where the banking company or its customers can alter the level and timing of their cash flows. For IRRBB purposes, option chance can be broken down into two distinct but related sub-types:

(a)

automatic option risk arising from standalone instruments, such as commutation-traded and over-the-counter choice contracts, or explicitly embedded inside the contractual terms of an otherwise standard financial musical instrument (eg a capped rate loan) and where the holder will nearly certainly exercise the pick if it is in their fiscal interest to do so; and

(b)

behavioural option take chances arising from flexibility embedded implicitly or within the terms of financial contracts, such that changes in interest rates may outcome a change in the behaviour of the client (eg rights of a borrower to prepay a loan, with or without penalty, or the right of a depositor to withdraw their residual in search of higher yield).

98.16

In addition to the pure economic risks that can arise from changes to the level and structure of interest rates, risks tin can arise from:

(i)

currency mismatches, ie where the interest charge per unit risks are in add-on to normal exchange charge per unit risks (this falls within a wider definition of ground risk); or

(2)

accounting treatment of risk positions, ie where interest rate hedging activity may achieve the desired economic effect, but fail to accomplish hedge accounting treatment.

Measurement of IRRBB

98.17

There are ii complementary methods of measuring the potential impact of IRRBB:

(1)

changes in expected earnings (earnings-based measures); and

(ii)

changes in economic value (EV, or EVE when measuring the change in value relative to equity).

98.eighteen

The two methods are complementary in that:

(1)

both measures reflect the impact of changing cash flows arising from changing interest rates;

(2)

the modify in expected earnings is reflected in the change in economic value; and

(iii)

they are affected by common assumptions.

98.19

The key differences betwixt the measures include:

(1)

Upshot mensurate: EV measures compute a alter in the internet present value of the balance sheet under an interest charge per unit stress. In undertaking such a adding, a decision has to be made virtually whether the issue should be computed equally a modify in the theoretical economical value of equity (EVE) – in which case, equity is either excluded from the EV calculation or included with a very short (overnight) elapsing; or whether the outcome should measure the alter in economical value other than for avails representing equity – in which case, disinterestedness is either included with the aforementioned elapsing as the assets which it is accounted to be financing, or else both equity and its portfolio of financed assets are excluded (this is earnings-adjusted EV). EVE and earnings-adjusted EV are therefore specific forms of an EV measure. All EV measures tin be expressed relative to equity, but EVE includes the alter to equity value that would consequence from revaluing under stress its own financed portfolio of avails. Earnings-based measures focus on changes to hereafter profitability. To the extent that future earnings somewhen impact levels of future equity, the 2 measures are aligned, but the value changes estimated include adjustments to cyberspace income that occur beyond the horizon for earnings measures.

(two)

Fourth dimension horizon: EV measures reflect changes in value relative to equity over the remaining life of the balance canvass, ie until all positions have run off. Earnings-based measures comprehend only the short to medium term, and therefore do non capture in full those risks that volition go along to impact profit and loss accounts beyond the menses of interpretation.

(3)

Futurity transactions: EV measures unremarkably just focus on changes to greenbacks flows of instruments already on the remainder sheet. Earnings-based measures can be based on remainder sheet run-off, or a static balance sail, but more sophisticated or dynamic models tend to consider the touch on of new business organisation/production that is expected to exist written in the time to come, also as the run-off of existing business organization.

98.xx

For earnings-based measures, the focus for assay is the impact of changes in interest rates on future accrued or reported earnings.

98.21

The component of earnings that has traditionally received the nigh attention is NII, ie the deviation between full involvement income and total interest expense, taking account of hedging activity (eg via derivatives). This focus reflects both the importance of NII in banks' overall earnings and its directly link to changes in interest rates.3

98.22

An earnings-based measure out offers the possibility of measuring take chances under a range of different time horizons. The normal focus is on the short/medium-term horizon (typically one to iii years, no more than five years), to limit the cumulative affect of underlying assumptions and the complexity of the calculations. Equally a consequence, an earnings-based measure is better suited to measuring the short- and medium-term vulnerabilities of the bank to IRRBB, assuming that information technology is able to continue in business (a going-concern viewpoint).

98.23

An earnings-based mensurate is therefore usually used to assess the power of a depository financial institution to generate stable earnings over a medium-term horizon, which will let information technology to pay a stable level of dividend and reduce the beta on its equity price and therefore reduce its cost of uppercase. Hence, information technology is a measure in line with internal management and asset and liability management objectives.

98.24

In club to exist able to calculate changes in expected earnings nether different interest charge per unit shocks and stress scenarios, an establishment volition need to be able to projection future earnings under both the expected economical scenario that informs its corporate programme, and the involvement charge per unit stupor and stress scenarios then that the differences can be measured. Such projections involve a range of farther assumptions about customer/market behaviour, and the banking company'south own management response to the evolving economic climate, including:

(1)

the book and blazon of new/replacement avails and liabilities expected to be originated over the evaluation period;

(ii)

the volume and type of asset and liability redemptions/reductions over that period;

(3)

the interest rate basis and margin associated with the new assets and liabilities, and with those redeemed/withdrawn; and

(4)

the touch of whatever fees nerveless/paid for do of options.

98.25

In applied terms, this may result in modelling of earnings under three different states:

(1)

run-off residual sail: existing assets and liabilities not replaced every bit they mature, except to the extent necessary to fund the remaining balance sheet;

(two)

constant residual sheet: total balance sail size and shape maintained by bold like-for-like replacement of assets and liabilities equally they run off; and

(3)

dynamic balance sheet: incorporating future business concern expectations, adjusted for the relevant scenario in a consistent manner, ie this is the most meaningful arroyo.

98.26

Under an economic value arroyo, the measure out of IRRBB is the theoretical alter in the internet embedded market place value of the whole banking volume.

98.27

The EV of a tradable musical instrument is its present value (PV). In the absence of embedded options, the PV of the musical instrument is adamant from its contractual greenbacks flows, which are discounted to reflect current marketplace rates. Every bit a commencement implication, instruments with curt-term or variable rate cash flows have a present value that more nearly equals their face value (ie their carrying value). As a second implication, a modify in market place rates would not change the EV of such instruments. Tertiary, the PV of an interest rate-sensitive instrument with uncertain contractual greenbacks flows tin can just exist valued on the basis of assumptions most behaviour and timing, which will tend to vary dependent upon external factors.

98.28

Applying the concept of EV to the whole residual sheet of a banking concern is more challenging: the banking volume contains assets and liabilities that are deemed for at held-to-maturity valuation, and for which there may not be appreciable marketplace prices (eg loans and receivables are non equally readily marketable and their market value cannot be determined directly). Moreover, there may exist embedded under- and overvaluations in the book on a marking-to-marketplace footing, representing income or costs that will emerge in futurity reported earnings. In improver, margins on loans may exist very heterogeneous, thus making decision of an appropriate discount charge per unit problematic, and the greenbacks flows that are being valued are discipline to variation depending upon client behaviour in response to charge per unit changes (and customers may not behave as might rationally be expected). Finally, there may be structural positions (eg avails held to stabilise render on non-maturity deposits and/or equity) which will produce a significant modify in value under EV measurement, but where the risk measured is a direct corollary of chance reduction from an earnings volatility perspective.4

98.29

To avoid the complication of measuring total EV, banks typically therefore focus on measuring the level of change to the cyberspace present value of the relevant balance sail items, based on existing or adapted cash flows that are revalued in line with the interest rate daze and stress scenarios. The change in the valuation is a mensurate of the level of IRRBB, and can be compared with the current value of equity to determine the change to the EVE.

Key considerations and assumptions

98.30

Both measures of IRRBB are significantly impacted by assumptions fabricated for the purposes of gamble quantification:

(1)

the range of shocks to the possible changes in the level, gradient and shape of involvement rate yield curves that are required to produce an IRRBB consequence on EV or earnings, and the economic stress scenarios that would be consistent with these shocks;

(2)

expectations for the exercise of options (explicit and implicit) past both the banking company itself and its customers nether the given scenarios;

(three)

handling in risk quantifications of balances and interest flows arising from non-maturity deposits (NMDs);

(four)

the bank's own determination of the implied investment term of the banking concern'due south ain equity capital liability; and

(5)

the implications for IRRBB of adopted bookkeeping practices.

98.31

In gild to produce a quantitative gauge of IRRBB, it is necessary to assume a shock to electric current interest rate levels, which would let the change in EV or earnings, and ultimately the result on disinterestedness, to be computed. The size and shape of the daze will make up one's mind the measured outcome, and a range of shocks may be needed to place all the potential facets of IRRBB (eg basis risks would not be captured by shocks that assume only parallel shifts of similar breakthrough in all yield curves). Designing interest rate modify scenarios that are relevant to the business and sufficiently stressful is a key element of IRRBB management

98.32

Behaviour of choice positions is 1 of the central set of assumptions that drive gamble quantification measures. The approach taken by banks more often than not differs between automatic options, where the customer and bank tin can presume that the exercise of options will exist based on rational expectations, and behavioural options, where behaviour will not e'er be rational and behavioural assumptions need to be used instead.

98.33

Automatic option positions tin can therefore be valued on the ground that do will always (and only) occur when there is financial benefit (with valuation based on standard financial modelling techniques and the results are fed into EV estimates). The rational expectation that the options will exist exercised can besides be readily fed into forward projections of involvement margin under earnings-based measures.

98.34

Behavioural option positions crave more complex analysis of expected outcomes, since customers may practise some options fifty-fifty when it is not in their financial interest to do so, or may non exercise options even when it would be to their benefit. The most complex area of behavioural assay is for prepayment options on loans: the right to redeem early may be included voluntarily in a loan contract, or imposed on the lender by performance of national law; there may or may not be early redemption penalties payable, simply again the size of these penalties may not reflect the actual economic costs and benefits involved (eg if limited past police or past operation of client redress policy); and customers may cull to redeem for other reasons than the availability of a new loan at lower price (eg due housing prices, borrowers' demographics, changing family limerick, taxation changes).

98.35

However, not all borrowers will act irrationally, and exercise of early on redemption options will tend to take a detrimental consequence on either an EV or an earnings-based measurement, ie in a classic instance of convexity risk, borrowers volition tend to repay stock-still charge per unit borrowings when rates autumn (so that they can borrow once again at a lower charge per unit) and retain fixed rate positions when marketplace rates ascent (and so that banks are unable to lend at the college rates). In gild to manage this redemption or extension take chances, banks model their books to establish how much should be hedged, and for what period, in order to match their best expectations of greenbacks flows. Such behavioural modelling is conspicuously prone to error, and needs frequent updating and so that hedge positions tin be adapted. Therefore, when using economic value and earnings-based measures, banks need to review and adapt their calculations to account for whatever expected behaviours.

98.36

The utilise of economic value and earnings-based measures involves estimating cash flows, only the content and treatment is different: for EV measures, all existing balance sheet items (both principal and interest flows) are discounted at a relevant rate, whereas NII measures include all cash flows, including all margins and chief flows from expected future business, and are commonly non discounted.

98.37

NMDs are liabilities of the banks in which the depositor is free to withdraw at any fourth dimension since they have no contractually agreed maturity appointment. Notwithstanding, NMD balances have historically proved to be relatively stable in practice, even when market place rates change, and balances lost tin commonly be replaced with new deposits at the aforementioned charge per unit – so, overall, NMDs conduct differently to other more rate-sensitive funding.5 Any interest paid on NMDs is commonly at rates significantly below those paid for wholesale or larger-denomination deposits, so NMD balances have historically represented an important source of stable and cost-effective funding.6

98.38

In because IRRBB, the focus for some banks is therefore primarily on managing the risk of earnings volatility arising from NMDs. In order to accomplish this, banks get-go identify core deposits, ie that element of NMDs that tin be considered to exist particularly stable under different interest rate scenarios so that a behavioural maturity can be ascribed specifically to them and matching assets allocated to stabilise earnings. In assessing cadre balances, banks discount those elements of transactional accounts which are subject to regular fluctuation (withdrawal followed by re-deposit) and overall seasonality of the NMD book.

98.39

The matching book of assets may then be managed dynamically to adjust for changes in levels of core deposits, and to maintain a abiding maturity in line with expected behaviour and the depository financial institution's run a risk ambition. Although the behavioural maturity may be determined to exist very long, the matching asset position carries risk to a banking company's EV since, being fixed rate and of some duration, the internet nowadays value of this portfolio volition vary with general involvement rates. The maturity profile chosen will therefore be a compromise betwixt protection of earnings for an extended period and increased risk to EV that could materialise on a shock event (eg a deposit run on NMDs, failure of the banking concern). Internal risk measures can be used to evaluate the extent and impact of the compromise fabricated.7

98.twoscore

In the same way as with NMDs, a bank's own disinterestedness majuscule liability represents an important source of structural risk and endowment return – in accounting terms, equity is the net value of avails less liabilities, so information technology represents avails for which there are no funding liabilities. Equity unremarkably has a cost in the class of a dividend (although not in the example of mutual or cooperative organisations), and banks therefore seek to stabilise the earnings that can be fabricated on avails funded by equity.

98.41

The technique involves defining net equity capital that is eligible for behavioural treatment – some assets are non-interest bearing (eg land and buildings) and may exist considered to be financed by equity, and so the value of equity available for behavioural treatment may be reduced accordingly.viii Since disinterestedness capital has no contractual price reset date, banks determine their own strategies for managing the earnings volatility that arises from it using techniques similar to those for NMDs. Given that equity may exist written down as a result of losses, regulators volition normally focus on the EVE risk associated with whatever earnings profile ascribed to equity that may materialise equally losses nether stress events.

Quantifying IRRBB: economical value

98.42

Alter in economic value can exist measured using a variety of techniques, the almost mutual of which are:

(1)

PV01: present value of a unmarried ground point change in involvement rates based on gap analysis;

(two)

EVE: economic value of equity; and

(iii)

EVaR: economic value at risk.

98.43

The techniques differ in their complexity and ability to capture different types of interest rate sensitivity (gap gamble (parallel and non-parallel), yield bend risk, basis risk and pick take chances). Multiple measures of EV sensitivity therefore produce a better overall understanding of risks embedded in the cyberbanking book.

98.44

Gap assay can be used to derive the duration profile of the cyberbanking book or, equivalently, the profile of the present value of a single basis bespeak change in interest rates (PV01). Gap analysis allocates all relevant interest rate-sensitive avails and liabilities to a certain number of predefined fourth dimension buckets according to their side by side contractual reset date. The analysis also allocates equity, NMDs, prepaying loans or other instruments with future greenbacks flows subject field to client behaviours according to general/behavioural assumptions regarding their maturity or reset date. It then measures the arithmetic difference (the gap) between the amounts of assets and liabilities in each time saucepan, in absolute terms. Each time bucket gap can be multiplied by an assumed modify in interest rates to yield an approximation of the change in NII that would result from an increase in interest rates. This method gives a visual impression of the chance exposure dispersion relative to the repricing profile, reflecting exposures to parallel as well as non-parallel gap adventure. It does not, however, quantify this risk.9 The measure assumes that all positions within a detail time saucepan mature and reprice simultaneously, ignoring potential basis risks within the gaps.

98.45

EV measures mainly focus on valuing the cash flows arising from existing assets and liabilities nether unlike hereafter interest scenarios, ignoring future business flows. The alter in EV (ie the change in the NPV of future cash flows every bit a issue of a modify in rates) tin can be calculated across all types of avails and liabilities. When a change in the EV of the whole banking volume is calculated, the consequence is highly influenced by the treatment of the banking company's own equity majuscule liability in the adding. There are two possible approaches:

(1)

Since accounting equity is the net residual figure that arises from subtracting total liabilities from full assets (including off-balance sail items), measuring the modify in the net present value of those assets and liabilities under a stressed interest rate scenario shows the actual level of chance to the economic value of disinterestedness. In this calculation, therefore, no rate or term is practical to equity itself, which is therefore excluded, and the NPV outcome is compared with the starting value of disinterestedness in guild to measure the proportionate size of the change. This is the EVE measure.

(2)

Given that equity finances surplus assets that earn an endowment return for the bank, the change in value of any nugget portfolio that has been created to reduce the volatility of earnings on disinterestedness is not a relevant EV risk for the banking concern (ie it has taken the EV risk specifically to hedge earnings take chances). In this calculation, therefore, disinterestedness is included in the calculation and treated as having the aforementioned involvement rate/term characteristics as the portfolio of assets that hedges the earnings on it. The NPV outcome is still compared with the starting value of disinterestedness, but measures only risks arising from non-structural positions. This measure is earnings-adjusted EV

98.46

EVE measures the theoretical change in the net nowadays value of the balance sheet excluding equity. The mensurate therefore depicts the modify in equity value resulting from an involvement rate daze. Under this method, the value of equity under alternative stress scenarios is compared with the value under a base of operations scenario. All cash flows from on-residue sheet and off-balance sheet interest charge per unit-sensitive items in the banking book may be included in the computation. The market value of equity is computed as the present value of asset greenbacks flows, less the present value of liability cash flows, without including assumptions on the interest rate sensitivity of equity. For internal measurement purposes, a bank may complement its ciphering of EVE with a dissever earnings-adjusted EV model that uses assumptions about the investment term of equity, whereby its interest rate sensitivity is taken into account.

98.47

The accuracy of the measure is extremely dependent upon the precision of the cash flows calculated, and on the discount rates used in the adding. When the expected cash flows are calculated, any likelihood that the size and the timing of future cash flows may differ between scenarios depending upon customer behaviour in reaction to the rate environs needs to be considered.

98.48

Depending on its specific design, an EV/EVE measure tin can capture all types of involvement rate sensitivity. Gap risk (parallel and non-parallel) will be captured depending on the specific yield bend risk used in the alternative scenario. In computing EV, a total revaluation of automated options would be normal nether each of the alternative scenarios, then automated option gamble measurement is an integral office of a standard EV measure. Behavioural optionality can besides exist captured if stressed behavioural assumptions are used in alternative scenarios. Banks can so compute the EV effect of a alter in customer behaviour either separately or in conjunction with a yield curve shift.

98.49

EV is a technique that can also be used to estimate footing risk in the cyberbanking book, either in isolation, or when combined with a general yield curve shift or with a change in causeless parameters. Footing risk can be measured by designing a scenario under which at that place is a difference in the unlike base rates to which a bank is specifically sensitive.

98.l

Economic value at risk (EVaR) measures the expected maximum reduction of market place value that can be incurred nether normal market circumstances over a given time horizon or belongings period and subject to a given confidence level. For adding of EVaR in the cyberbanking book, the changes in the market value of the cyberbanking book and thus of the equity are computed for a gear up of alternative yield curve scenarios. When the EVaR approach is applied to the banking book, the time horizon is normally consequent with the economical model of the banking book. The standard VaR approach comprises three different techniques: historical simulation, variance-covariance arroyox and Monte Carlo simulation.

98.51

EVaR models are suited to capture all types of involvement charge per unit sensitivity such every bit EVE. However, EVaR measurement techniques accept their limitations. EVaR is designed for normal market circumstances and does non adequately assess tail risk. Both historical value-at-run a risk (VaR) and variance-covariance VaR are backward-looking methods which are decumbent to missing the tail events that carry significant risks. The Monte Carlo simulation method is very enervating in terms of technology and computational power.

Quantifying IRRBB: earnings-based measures

98.52

Earnings-based measures wait at the expected increase or reduction in NII over a shorter fourth dimension horizon (typically ane to three years, up to a maximum v years) resulting from interest charge per unit movements that are composed of either a gradual or a one-fourth dimension big interest rate shock. The change in NII is the difference in the expected NII betwixt a base scenario and an alternative, more stressful scenario. The base of operations case scenario reflects the bank's current corporate plan in projecting the volume, pricing and repricing dates of future business transactions. Interest rates used for resetting transactions in the base scenario can be derived from market expected rates or from spot rates. The rate for each instrument will also contain appropriate projected spreads and margins.

98.53

In assessing the possible extent of modify in NII, banks can use models to predict the path of rates and the run-off of existing assets and liabilities. Earnings measures can be differentiated according to the complication of their forward calculations of income, from simple run-off models which assume that existing assets and liabilities mature without replacement, to abiding balance sheet models which assume that assets and liabilities are replaced like for like, to the nigh complex dynamic models which reverberate the changes in the volumes and types of concern that will be undertaken (or non undertaken) in differing interest charge per unit environments, with the expected level of prices in those circumstances.

98.54

An earnings-based measure analyses the interest rate risk contour of the banking volume in a detailed manner tailored to the bank's specific circumstances. As it can business relationship for new business organization, it reflects a full going-business organisation perspective. Depending on the design of the culling scenarios, this method is able to capture all different types of interest rate risk sensitivity. Banks are able to incorporate fully the cash flow changes that occur under alternative scenarios due to automatic options.

98.55

However, the results of the modelling are highly sensitive to assumptions virtually customer behaviour as well as to the predictable direction responses to different rate scenarios. Earnings-based measures encompass a relatively brusk fourth dimension horizon, so changes in earnings falling beyond the observation period are ignored (including those arising from any behavioural treatment of NMDs and/or equity that involves long-term structural positions to reduce earnings volatility). Concluding but non least, earnings-based measures practice non necessarily place the risks to uppercase that tin can arise from revaluation of available-for-sale portfolios.

Derivation of the involvement rate shocks

98.56

SRP31 describes six prescribed interest rate stupor scenarios that banks should employ to parallel and non-parallel gap risks for EVE and two prescribed involvement rate daze scenarios for NII. In society to derive these shocks, the following general steps are taken.

98.57

Step one: generate a 16-year time series of daily boilerplate interest rates for each currency c. The average daily involvement rates from the year 2000 (iii January 2000) to 2015 (31 December 2015) are independent in Tabular array i. The average local percentile of the rate series is adamant by calculating the average rate across all daily rates in time buckets 3m, 6m, 1Y, 2Y, 5Y, 7Y, 10Y, 15Y and 20Y.

| Average interest rates past currency | Table one | |||||||||||

| ARS | AUD | BRL | CAD | CHF | CNY | EUR | GBP | HKD | IDR | INR | ||

| Average | 3363 | 517 | 1153 | 341 | 183 | 373 | 300 | 375 | 295 | 1466 | 719 | |

| JPY | KRW | MXN | RUB | SAR | SEK | SGD | TRY | USD | ZAR | |||

| Average | 89 | 471 | 754 | 868 | 360 | 330 | 230 | 1494 | 329 | 867 | ||

98.58

Pace 2: the global shock parameter is prescribed based on the weighted average of the currency-specific shock parameters, . The shock parameter for scenario i is a weighted boilerplate of the α i,c,h across all currencies and divers every bit α i. The following baseline global parameters are obtained:

| Baseline global interest rate stupor parameters | Table 2 | ||

| Parallel | | 60% | |

| Short rate | | 85% | |

| Long rate | | twoscore% | |

98.59

Applying the α i from Tabular array 2 to the average long-term rates from Table 1 results in the revised involvement rate shocks by currency for parallel, short and long segments of the yield curve in Table 3.

| Revised involvement rate shocks, | Table 3 | |||||||||||

| ARS | AUD | BRL | CAD | CHF | CNY | EUR | GBP | HKD | IDR | INR | ||

| Parallel | 2018 | 310 | 692 | 204 | 110 | 224 | 180 | 225 | 177 | 880 | 431 | |

| Brusque | 2858 | 440 | 980 | 290 | 155 | 317 | 255 | 319 | 251 | 1246 | 611 | |

| Long | 1345 | 207 | 461 | 136 | 73 | 149 | 120 | 150 | 118 | 586 | 288 | |

| JPY | KRW | MXN | RUB | SAR | SEK | SGD | Endeavour | USD | ZAR | |||

| Parallel | 53 | 283 | 452 | 521 | 216 | 198 | 138 | 896 | 197 | 520 | ||

| Short | 75 | 401 | 641 | 738 | 306 | 280 | 196 | 1270 | 279 | 737 | ||

| Long | 35 | 188 | 301 | 347 | 144 | 132 | 92 | 597 | 131 | 347 | ||

98.60

However, the proposed interest rate shock scale tin lead to unrealistically low interest rate shocks for some currencies and to unrealistically high interest rate shocks for others. In order to ensure a minimum level of prudence and a level playing field, a flooring of 100 basis points and variable caps (denoted as ) are fix for the scenarios concerned, those caps being 500 basis points for the short-term, 400 basis points for the parallel and 300 ground points for the long-term interest rate shock scenario.

98.61

The alter in the risk-free interest rate for daze scenario j and currency c can exist defined as follows, where is 400, 500 or 300 when j is parallel, short or long respectively.11

98.62

Applying the caps and floors to the shocks described in Table 3 results in the final fix of interest rate shocks past currency that is shown in SRP31.90.

98.63

Supervisors may, applying national discretion, set a higher floor under the local interest rate shock scenarios for their home currency. Supervisors may as well, applying national discretion, set a nothing or negative lower bound for the post-shock interest rates, where:

Source: https://www.bis.org/basel_framework/chapter/SRP/98.htm

Posted by: burgessanist1997.blogspot.com

0 Response to "What Is The Expected Change In Equity Value If All Yields Increase By 300 Basis Points?"

Post a Comment